Foreword:

This guest lecture was held for a class in 2020 at MBA ITB, Bandung, Indonesia. Hence, the legal terms in this writing will refer to the laws that apply in Indonesia.

In April 9th 2020, a guest lecture class was held with Dr Chandra Yusuf, S.H., L.LM., M.B.A., M.Mgt as presenter and shared regarding the Corporate Governance and Good Governance. As he’s a practitioner in law and management business, He started the topic with theories especially in Law sides. There are legal subjects that consists of Naturlijk Persoon and Recht Persoon in the term of Law. This divide the legal subject to individuals and corporation. According on Law №40 of 2007, corporation have a legal construct that creates their legal identity and shows its owner whether it’s a CV, Private Law Firm, or business entity that isn’t a legal entity. As for corporation in article 1 paragraph 1, it stated that incorporated company is a legal entity who do capital alliance, that was build through agreement, do working activities with an authorized capital that is all divided in share and fulfil the defined requirement in this law with its implemented regulations.

Good governance starts from incorporated company that consists of company’s organs such as General meetings of Shareholders (RUPS), Directors, and Board of Directors. There is also a term in incorporate company which is corporate shield that is explained in article 3 on Law no. 40 of 2007. It is stated that, shareholders of Inc aren’t responsible personally over the engagement that was created over the Inc name and over the company’s losses exceed the shared owned. The statement above aren’t applied if:

a. Inc requirements as a legal entity aren’t fulfilled yet

b. Shareholders that are concern directly or indirectly with bad faith and exploits the Inc for personal purposes

c. Shareholders that are concern directly or indirectly with the Inc and involved with against the law that is done by the Inc

d. Shareholders that is concern directly or indirectly with the Inc and involved with against the law that result in company’s wealth to be insufficient to pay off its debt

As there are company’s organs that are functionally different such as directors (management), BOD, and RUPS. The director function in article 92 paragraph 1, state that its function is to run the company’s management for company’s interest and to make the shareholder wealthy. Directors are also representing the company that is explained in article 98 paragraph 1. It stated that directors representing the company inside and outside court. Thus, directors are the one who’ll be sued in lawsuit. In paragraph 2, it is explained that director that are more than one, people who’s authorized are every director except it is stated in articles of association.

The directors are appointed by RUPS based on article 94 paragraph 1. Thus, the power is in the RUPS. In order to tie the RUPS, it’ll require notarial deeds. Since directors are appointed by RUPS, the one that appoint RUPS itself is fund manager or firm that can be submitted during IPO. Therefore, RUPS is above director in term of levels in company’s organ.

Directors are also expected to have loyalty toward shareholders because it has a Fiduciary Duty. It’s a legal liability from one party to act for other’s interest. The party required are usually fiduciary. It’s someone that is trusted to manage the funding or property. According to economy of Adam smith, the loyalty is in the form to maximize the satisfaction (in the form of money) that will be shared to the shareholders. In this stage, the directors and BOD are on the owner side. Directors have contracts with the company, while BOD works as supervisor. Thus, both need to stand on its own in order for the company to work correctly and both work for the shareholders.

CEO is part of the managements because according to Black Law dictionary, it’s a corporation’s highest-ranking administrator, who manages the firm day by day and reports to the boards of directors. Therefore, the level top to bottom would be owner, management, executive, and head of division.

The management according to Parker and Foleil is an art to finish the task through someone else. It is the administrator of organization, whether it is a business, NGO, or government entity. Since all of the task are the job for management to managers, therefore having Good governance is important. Governance means to be expertise in uniting all of the stakeholders. In order for the governance to work, it requires Planning, Organizing, Directing, and Controlling by the management that was directed by the directors.

Good governance is defined according to each word. Good in adjectives is having the qualities required for a particular role. As for noun, Good is a benefit or advantage to someone or something. Lastly, in adverb informal good means well. Next would be the governance. It is a term for the action or manner of governing.

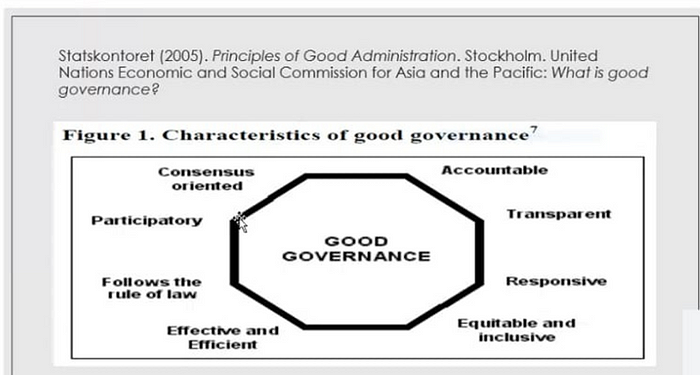

Corporate governance is what MBA are mostly focused on. Therefore, it is a series of process, habits, policy, rules, and institution that affect the direction, managing and controlling on one company or corporation. The characteristic of corporate governance is; participation, consensus oriented, accountability, transparency, responsive, effective and efficient, equitable and exclusive, follows the rules of law and have strategic vision. Since the directors are the one who creates the visions, MBAs are the one who runs the governing to be better.

There are two types in governance which is governing and controlling. Controlling is whether one can do as the other person says. As for governing requires incentive management and flexible. However, Indonesia is still using Laws no. 40 of 2007 and still considered as controlling because all runs for the shareholders. There are also two approach in corporate governance, which is discipline and dynamic. Discipline is based on Laws and approach to only one stakeholder. As for dynamic tend to approach to many stakeholders. Indonesia is mostly still using discipline approach. However, the development of CSR is being held that cause the discipline slowly moving to dynamic.

The problem is whether to consider CSR to be operational or separated from the company. This will create confusion in integrating the problems in financial reports because if it’s for operational, the question will be whether the activity is related with the product or not. If it’s for the sake of product it will be tax free. If it’s separated from the company, it would be a problem to which place should the reports to be in. Since it requires the company’s fund and will affect its profit or cost production itself.

—

This writing is used as one of the assignments in Business Strategy and Enterprise Modelling class that I took at 2020.